Foreign Currency Conversion Fee Antitrust Litigation

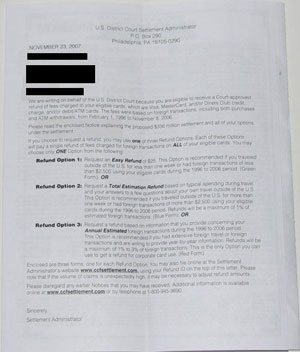

If you live in the U.S. and made a purchase with a debit card or credit card in any other country between February 1, 1996 and November 8, 2006, there's a good possibility that you qualify for some kind of reimbursement for some amount of reimbursement for a portion of the foreign currency conversion fees charged by your card's issuing bank.

Here's what the site says about the charges:

Plaintiffs challenge how the prices of credit and debit/ATM card foreign transactions were set and disclosed, including claims that Visa, MasterCard, their member banks, and Diners Club conspired to set and conceal fees, typically of 1-3% of foreign transactions, and that Visa and MasterCard inflated their base exchange rates before applying these fees. The Defendants include Visa, MasterCard, Diners Club, Bank of America, Bank One/First USA, Chase, Citibank, MBNA, HSBC/Household, and Washington Mutual/Providian. They deny the Plaintiffs' claims and say they have done nothing wrong, improper, or unlawful.

I know I've been to Mexico and China once each during that time frame, along with making several trips to Canada. What I don't know is if it's worth digging through old statements and receipts to try and get reimbursed for what likely amounts to only a few dollars. The FAQ says that the issuing bank for each card has to provide me with any statements I don't currently have in my possession in order to make a claim, but I'm still unclear about whether this is actually "worth" doing.

From the FAQ about reimbursement:

Can I submit estimated yearly foreign transactions for years where my records are either incomplete or I no longer have statements to support my transactions?First a reminder: Pursuant to the Revised Plan of Administration and Distribution, paragraph 5(f), Exhibit H, to the Stipulation and Agreement of Settlement, the Bank Defendants shall provide, free of charge, your monthly billing statements, if retrievable electronically, to any Settlement Damages Class Member who request these statements to substantiate his or her claim form. If you are a customer of Household/HSBC or Providian/Washington Mutual, you should contact the Settlement Administrator for your electronically retrievable transaction records.

If you decide to file for Refund Option 3 you need to list the amount of foreign transactions by year. If your records remain incomplete and you are unable to obtain them from your bank, you may calculate yearly foreign transactions using estimates. You should calculate these estimates based on reasonable daily or monthly spending, documented, where possible, by a travel journal or some other proof of your travel or your living arrangements outside of the United States. Although you do not need to submit any documentation with your claim form, you should retain the supporting materials, along with a written explanation of the methodology used to determine the estimates listed on your claim form, in case your claim is designated for audit by the Settlement Administrator.

It's my money and I'm entitled to it, but I have a feeling that the opportunity cost of tracking down my foreign purchases will be greater than the subsequent checks I might get back from various banks. Maybe if I were making weekly trips out of the country. Anybody else seen a reason to chase down this reimbursement?